Income earned in the U.S. is generally taxed at 3 levels: federal, state, and local. However, even if you did not earn income in the U.S., you still must file something during tax season every year.

2025 Tax Filing

All international students and scholars will receive a detailed email from OISS in mid-February with information about tax filing.

Please see the PDFs below for information that will be covered by Payroll's 2026 presentation over preparing your 2025 taxes.

Student and Scholar Tax Process

Possible Income Forms from Lehigh:

- W-2: from Payroll Office, available for download from Self-Service Banner

- 1042S: from Payroll Office, will receive email in February if you have one. If you've received a fellowship/scholarship or a stipend from working as a TA/RA/GA in 2025, you may have a 1042S. Pickups from Payroll are by appointment only and you must have your Lehigh ID. Make an appointment at: https://calendly.com/ajt207-lehigh to expedite your pickup.

- 1098-T: *only for tax residents, from Bursar’s Office, available on eBill Suite or sent by mail

OISS’s ability to offer in-person tax clinics through NoRTH (outside tax assistance) depends directly on how many NoRTH-trained tax volunteers are Lehigh-based. Since we don’t have enough volunteers for TY2025, our NoRTH tax clinic offerings will be online-only. If you are interested in becoming a tax volunteer, please find more information here!

**Please note that OISS staff are not trained tax professionals and are not legally able to answer tax-specific questions.

**If you have questions about how to file your taxes, we recommend that you make use of the resources linked below.

Section 1

Getting StartedTAX RESIDENCY

- Determine your tax residency (nonresident alien, resident alien, or dual-status alien)

- The Substantial Presence Test is what determines your tax residency in the U.S. If you have been in the U.S. long enough, you will be taxed like a U.S. citizen, which is the “resident alien” category. However, if you have not been in the U.S. for long enough, you will be exempt from the SPT and very likely categorized as a “nonresident alien.” The dual-status alien category is much less common.

- The easiest way to determine your residency status is with this tool: Am I a Nonresident Alien?

- Select the tax year, then enter your U.S. travel history (from the I-94 website). The tool will tell you if you are a nonresident alien or resident alien (or dual-status alien), which decides how you file.

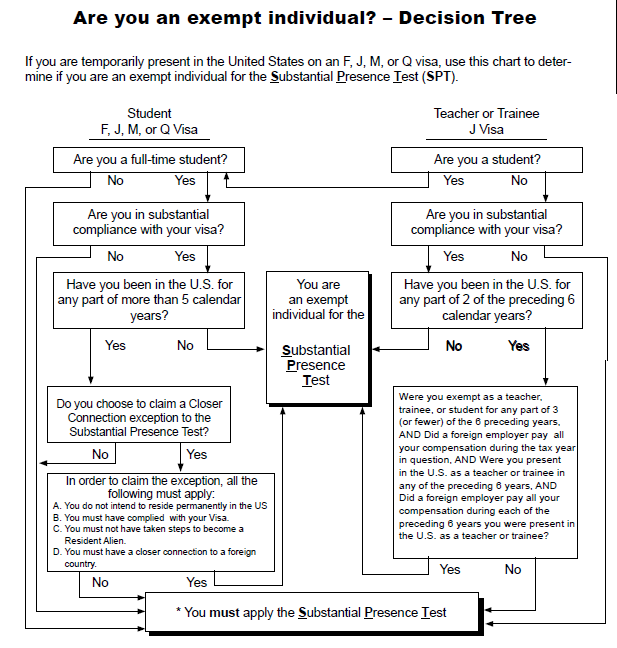

- It is also possible for you to determine your residency yourself, though the rules are complicated. The first thing to determine is if you are an “exempt” individual. In this case, exempt means exempt from the Substantial Presence Test, NOT exempt from paying taxes. If you are exempt, you are usually a nonresident alien. Use this flowchart to determine if you are exempt:

- If you are not exempt, then you are subject to the Substantial Presence Test to determine if you are a resident or nonresident alien. Use this flowchart to determine if you are a resident or nonresident alien:

Again, the easiest way to find the answer is to use the Am I a Nonresident Alien? tool linked above.

INCOME & FORMS

- Determine if you had income

- This will decide what tax forms you need to file.

- Income is usually reported on an income document. Your employer or institution who provided the income will send you the document in January/February of that tax filing season. They will either come in the mail or online. Common income tax documents include:

- W-2

- 1099

- 1042-S

- You have earned income in the U.S. if…

- You receive any U.S. income that is taxable. Taxable income can include (but is not limited to): wages from a job, non-tuition scholarships, interest, dividends, gains from stock sales, and earnings as an independent contractor.

- You receive a scholarship that is partially or totally tax-free due to a tax treaty.

- Nonresident alien, no income: ONLY need to file Form 8843

- Form 8843

- Step-by-Step Instructions

- Do not need an SSN/ITIN to file 8843!

- Nonresident alien, income: 8843 AND income tax return (1040-NR and other necessary forms)

- Resident alien, no income: more complicated, seek tax professional

- Resident alien, income: income tax return (1040 and other necessary forms)

- If you file a federal income tax return, you will probably also need to file state (PA) and local (Bethlehem) returns. See Section 2 for more details.

Section 2

How to FilehoW TO file

If you had taxable income from a job, you should have a Social Security Number (SSN). If you had taxable income without working, you were not eligible for a SSN and will need an Individual Tax Identification Number (ITIN) to file your taxes. If you are a Lehigh student or scholar who needs an ITIN, you will typically be contacted in December preceding the tax season by Debi Burkholder (deb310@lehigh.edu), who can help you with the application. If Ms. Burkholder is unable to help, you can seek ITIN guidance from the IRS office in Bethlehem.

OISS partner NoRTH

OISS partners with the NonResident Tax Help Group (NoRTH) to offer free tax assistance to most Lehigh students, scholars, teachers, researchers, and staff.

Request a free membership with NoRTH on their website or by using this direct link: Lehigh TY 2025 Membership (you must use an email ending in .edu or .org).

* If you are on OPT and no longer have access to your Lehigh e-mail, you should use your Lehigh alumni e-mail.

* If you were at Lehigh as a scholar and no longer have access to your Lehigh e-mail, please use your home institution email address.Your membership will give you access to tools, guides, individual support, and tax filing software. The software supports preparation and e-filing of both federal and state tax returns. NoRTH offers tax support over email and through remote tax clinic appointments.

Once you have your membership, you should review all tabs of NoRTH’s website to learn about their resources. The Am I a Nonresident Alien? and Personalized Guide tools are a great way to get started.

Other Software

Professional Tax Preparer (also known as a CPA)

If you have a complicated tax situation and have been advised to seek guidance from a CPA, you may send an email to intnl@lehigh.edu to receive some contacts. Loose estimates for CPA service costs can be found here.

Necessary Documents

Passport and U.S. entry/exit dates (travel history from I-94 site)

I-20 or DS-2019

If you earned income, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

All income documents (W-2, 1042-S, 1099, etc.)

Previous year tax return, if you filed

Section 3

State Tax, Local Tax, and Additional InformationSTATE INCOME TAX

If you had taxable income for Pennsylvania, you must file a Pennsylvania tax return by April 15th. To determine if you had PA income, take a look at Boxes 15 and 16 on your W-2. If Box 15 = PA and Box 16 = a number other than zero, you had PA income.

If you had taxable income for another state (Box 15 = other state, Box 16 = number (not zero)), you may also need to file a return for that state.

**The NoRTH tax software will prepare federal and state income tax returns. There is a guide for preparing Pennsylvania state tax returns, and guides are also available for several other states. If there is no guide for a particular state, you should review the website of that state’s Department of Revenue website for guidance.

LOCAL INCOME TAX

If you had taxable income for the City of Bethlehem (W-2’s Box 20 = BETHLEHEM, Box 18 = number (not zero)), you must file a local tax return by April 15th. If you had taxable income for another locality (Box 20 = city other than BETHLEHEM, Box 18 = number (not zero)), you may also need to file a return for that locality.

You may receive a mailed notice in the summer from Keystone Collections that pertains to the Bethlehem Area School District taxes. The tax is issued every year around the first week of July and is a standalone tax that is separate from local earned income taxes. There is an exemption for students which is as follows: "If you are an active student as of July 1st during the subject tax year (must be renewed yearly). Acceptable proof for the student includes a class schedule showing credit hours." Exemptions for the tax are listed on the back of the notice and can be submitted using the form on the notice or the invoice number on the notice. Please see Keystone Collections FAQs for more assistance.

**NoRTH’s tax software does not prepare local tax returns itself, but the Personalized Guide tool does provide instructions for preparing a local Bethlehem tax return.

ADDITIONAL TAX INFORMATION

Additional information on federal income tax obligations may be found here: Internal Revenue Service (IRS) Publication 515, Withholding on Nonresident Aliens and Foreign Corporations, and 519, U.S. Tax Guide for Aliens.

- 8843 Form and Information

- 1042-S Form and Information

- 1040-NR Form and Information

- 1040 Form and Information

- 1099-INT Form and Information

- 1099-DIV Form and Information

FILING BY MAIL

*Most income tax filing is completed online, but if you must file an income tax return through the mail, please read the following information.

If filing the 8843 alone, please mail it according to the instructions on page 3 of the form.

Nonresident Alien:

- If you are not including a payment, mail your return to the following address:

Department of the Treasury

Internal Revenue Service Center

Austin, TX 73301-0215

- If you owe taxes and are including a payment, please mail your return to:

Internal Revenue Service

P.O. Box 1303

Charlotte, NC 28201-1303

Resident Alien:

- Use the address shown in the 1040 instructions.

PENALTIES FOR NOT FILING OR FILING LATE

f you are required to file a tax return but fail to file by the due date, you may have to pay a failure-to-file penalty. The penalty is usually 5% for each month or part of a month that a return is late, but not more than 25%. If you are more than 60 days late, the minimum penalty is the smaller of $205 or 100% of the unpaid tax.

You may be subject to criminal prosecution (brought to trial) for actions such as 1) tax evasion; 2) willful failure to file a return, supply information or pay any tax due; 3) fraud and false statements; or 4) preparing and filing a fraudulent return.

There might also be immigration consequences for failing to file taxes. Applicants for permanent residency or green card are often asked to show proof of tax filing for previous years in the U.S.

For more information on penalties for failure to file returns or pay taxes as required, please refer to Page 37 of IRS Publication 519, U.S. Tax Guide for Aliens.